Claim Your $256 Savings Today!

SIGN UP for only $71.60!

for the first 100 sign-ups!

Hurry — spots are filling fast!

Start Repairing your credit with confidence!

Click below to claim your offer. We'll then reach out to answer any questions you may have.

How It Works

Step 1 – Claim Your Offer

Sign up today to get 60% off your Deep Credit Analysis + 1 month of free credit repair (a $256 value).

Step 2 – Set Up Credit Monitoring

Set up your credit monitoring so you can track changes, alerts, and improvements to your credit in real time.

Step 3 – Get Your Deep Credit Analysis

We review your credit reports to uncover errors, outdated items, and opportunities for improvement, then provide a personalized roadmap and action plan to strategically guide your credit repair and growth.

Step 4 – Start Credit Repair

We dispute inaccuracies on your behalf and begin restoring your credit profile immediately.

Step 5 – Build & Grow

With personalized strategies, ongoing guidance, and actionable steps, we'll not only repair past credit issues but also actively help you build new positive credit history, optimize your score, and guide you on how to protect and leverage your credit for long-term financial opportunities.

SIGN UP with confidence!

How Did You Hear About Us?

Facts matter!

General Credit Facts

Did you know?

1 in 5 credit reports has an error that can lower your score — and most people never know until they check.

Fact:

Even a 20-point boost in your score could save you thousands over the life of a loan.

Did you know?

Credit repair and credit building are two different strategies for improving your credit.

Fact:

Credit repair focuses on removing or correcting negative items that lower your score, while credit building involves strategically adding positive accounts and managing credit responsibly to accelerate score growth.

Did you know?

Our Value Advantage Plan ($119/month) focuses on repairing your credit by removing errors, outdated accounts, and other harmful items, while our Premium Advantage Plan ($149/month) goes a step further by combining credit repair and credit building to help you add positive accounts and boost your score faster.

Fact:

Both plans come with your first month free, so you can start repairing—and even building—your credit with no upfront cost.

Did you know?

Credit utilization (how much of your available credit you’re using) makes up 30% of your score.

Fact:

Keeping your balances low and adding new positive accounts can improve your credit health quickly.

CLIENT WINS!

Clients Results

The Approach:

One client followed our credit repair + building strategy for 2 months.

The Result:

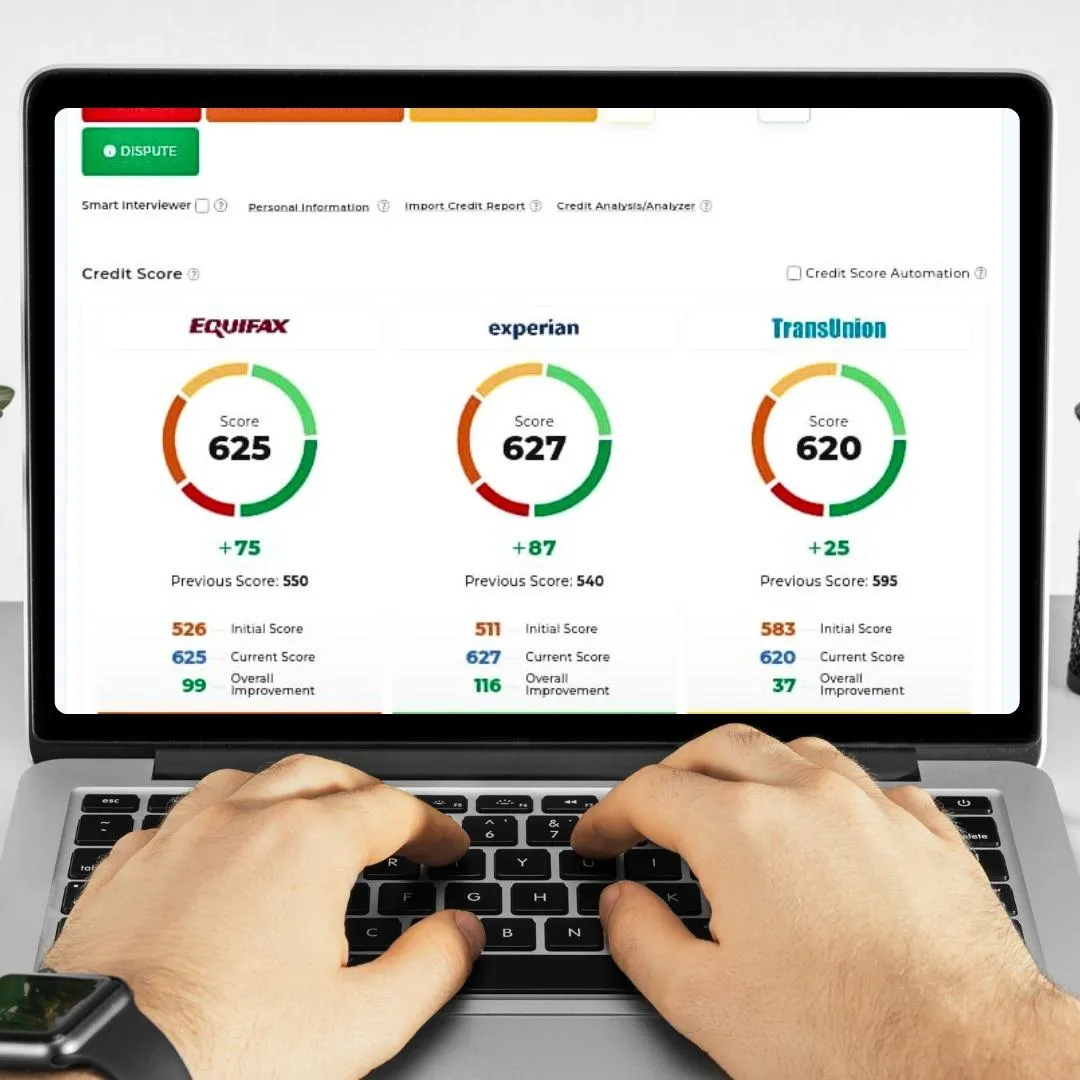

As seen at the photo, they gained an average of 84 points across all three bureaus (526 → 625 Equifax, 511 → 627 Experian, 583 → 620 TransUnion).

The Approach:

A client applied our strategies consistently for 90 days.

The Result:

They went from denied to approved for high-limit credit cards in just 3 months.

The Approach:

One client stayed committed for 6 weeks while repairing their credit.

The Result:

A 30-point boost helped them qualify for a car loan.

The Approach:

Clients who combine repair + building for 120 days.

The Result:

Often reach their highest scores in years, thanks to compounding positive accounts and deleted negatives.

Frequently Asked Questions

How do I get started?

The process begins with claiming your offer, which gives you 60% off a Deep Credit Analysis plus one month of free credit repair—a total savings of $256. Next, we set up credit monitoring so you can track changes, alerts, and improvements to your credit in real time. Once monitoring is in place, we complete your Deep Credit Analysis by reviewing your reports to uncover errors, outdated items, and opportunities for improvement. From there, we dispute inaccuracies on your behalf and start restoring your credit profile. Finally, we provide ongoing strategies and guidance so you can continue building new credit, strengthening your profile, and protecting your progress for the future.

Why do clients trust GAQ Consulting with their credit journey?

Many people come to us feeling overwhelmed by errors on their credit reports, discouraged by denials from lenders, or unsure where to start in rebuilding their financial standing. At GAQ Consulting, we take the time to understand these challenges and provide a personalized approach to every case. We carefully review each credit report and create a plan tailored to individual needs, never relying on generic solutions.

We also value transparency and education, helping you understand each step of the process so you can make confident decisions about your financial future. While results take time, our clients trust us because of our honest guidance, consistent communication, and genuine commitment to their success.

How long does the credit repair process take?

Since every credit report is unique, the timeline can be different for everyone. Some clients notice progress in just 2 months, while others may need a year or more. On average, most people see results within 6 to 12 months. Your exact timeline will depend on what’s in your credit report.

Can you guarantee my credit score will improve?

While we cannot guarantee a specific score increase, we can assure you that we use proven methods to challenge inaccuracies on your credit reports and provide guidance on healthy financial habits. As part of this process, we create a personalized action plan tailored to your situation, giving you a clear path forward. Many of our clients see meaningful improvements over time by following this strategy and staying consistent.

Why do I need to pay for credit monitoring?

Free tools like Credit Karma can be helpful, but they typically only show your VantageScore from two of the three major credit bureaus (usually TransUnion and Equifax). Most lenders, however, rely on your FICO score when making lending decisions. In fact, about 90% of banks and lenders use FICO scores—not VantageScores.

That’s why paid credit monitoring is so valuable: it provides a more accurate and complete picture of your credit. Through GAQ Consulting’s partnerships with trusted providers, our clients get exclusive discounted access:

SmartCredit – 7-days FREE, then $29.95/month

IdentityIQ – $32.86/month

These services ensure you see the same information lenders use, helping you make smarter financial decisions and track your progress more effectively.

How much does it cost?

With our current 60% discount promo offer, you can start your credit repair journey for as low as $71.60 (instead of the regular $179). This includes a Deep Credit Analysis, which gives you a full review of your credit reports to uncover errors, outdated items, and opportunities for improvement.

On top of that, you’ll also enjoy your first month of credit repair COMPLETELY FREE.

We offer two affordable monthly programs after your free month:

Value Advantage Plan – $119/month: Includes credit report reviews, dispute letters, and personalized guidance.

Premium Advantage Plan – $149/month: Includes everything in the Value Plan, plus access to our educational portal and one-on-one support for faster results.

In addition, to make sure you’re tracking the same information lenders use, GAQ Consulting partners with SmartCredit (7 days FREE, then $29.95/month) and IdentityIQ ($32.86/month) to provide accurate FICO-based credit monitoring at discounted client rates.

Altogether, this promotion gives you up to $256 in total savings—an affordable way to begin improving, protecting, and monitoring your credit with GAQ Consulting.